The Middle-Class Trap: Why Hard Work No Longer Secures Success

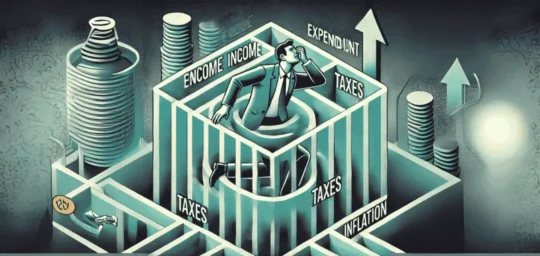

In today’s fast-evolving economy, the middle class finds itself caught in an increasingly precarious situation. What was once considered a pathway to financial stability and upward mobility is now fraught with challenges that threaten the very essence of what it means to be middle class. The promise that hard work would lead to success is fading, as taxation and rising living costs erode the financial stability of countless families. This phenomenon, often referred to as the middle-class trap, highlights the systemic issues preventing hard-working individuals from achieving their financial goals.

Understanding the Middle-Class Trap

The middle-class trap describes the cycle where middle-income families struggle to maintain financial stability despite diligent efforts to work hard and manage resources. The root causes of this trap are multifaceted, encompassing:

Stagnant Wages: While productivity has soared in recent decades, wages for the middle class have remained stagnant, failing to keep up with inflation and the rising cost of living.

Increased Tax Burden: Middle-income earners often shoulder a disproportionate share of the tax burden, leaving them with less disposable income compared to higher-income earners who benefit from tax loopholes.

Rising Living Costs: Essentials such as housing, healthcare, and education have become prohibitively expensive, further straining the budgets of middle-class families.

The Role of Taxation in the Middle-Class Trap

Taxation is one of the most significant factors contributing to the middle-class trap. While taxes are essential for funding public services, the structure of many tax systems disproportionately impacts middle-income earners. Here’s how:

Progressive Tax Systems: Although progressive taxation aims to tax higher earners more heavily, middle-class families often find themselves paying a substantial portion of their income due to limited access to deductions and credits available to the wealthy.

Indirect Taxes: Goods and services taxes (GST), sales taxes, and excise duties disproportionately affect the middle class. These taxes, which are the same regardless of income, consume a larger percentage of a middle-class family’s earnings compared to affluent households.

Bracket Creep: As wages slowly rise to keep up with inflation, many middle-income earners are pushed into higher tax brackets, effectively nullifying the benefits of their increased earnings.

The Rising Cost of Living

Another critical component of the middle-class trap is the relentless rise in living expenses. Let’s explore the key areas where costs have skyrocketed:

1. Housing Costs

For many families, homeownership was once a cornerstone of middle-class stability. Today, however, housing prices have outpaced income growth by a significant margin. In urban centers, even modest homes can cost several times the annual income of an average middle-class family. Renting, once an affordable alternative, has also seen a steep rise in costs.

2. Healthcare

Healthcare costs have become a financial burden for many middle-class families. Premiums for insurance, out-of-pocket expenses, and the cost of prescriptions have soared, leaving families vulnerable to financial ruin in the event of a medical emergency.

3. Education

The cost of higher education, often seen as the gateway to better opportunities, has skyrocketed in recent years. Many families incur significant debt to afford tuition and other related expenses, trapping them in a cycle of repayment that lasts for decades.

4. Childcare

For working parents, the cost of childcare is another factor that eats into disposable income. In many cases, families are forced to choose between paying for childcare and saving for the future.

The Illusion of Financial Progress

While many middle-class individuals believe they are making financial progress, the reality often tells a different story. Despite working longer hours or taking on multiple jobs, they find themselves:

Unable to save for retirement.

Struggling to pay off debt.

Falling behind on emergency savings.

Sacrificing vacations and leisure activities to make ends meet.

This constant financial strain fosters stress, anxiety, and a sense of hopelessness, further perpetuating the middle-class trap.

How Can the Middle Class Escape the Trap?

Addressing the middle-class trap requires a multifaceted approach involving policy changes, financial education, and community support. Below are some strategies that could provide relief:

1. Tax Reforms

Governments must prioritize tax reforms that lessen the burden on middle-income earners. This includes:

Expanding tax credits for families.

Reducing indirect taxes on essentials.

Eliminating bracket creep through inflation indexing.

2. Affordable Housing Initiatives

Policymakers should invest in affordable housing projects and offer subsidies or tax incentives to developers who prioritize middle-class housing needs. Additionally, rent control measures can help prevent exploitative practices in the rental market.

3. Healthcare and Education Reform

Making healthcare and education more affordable is crucial. Subsidized insurance plans, student loan forgiveness programs, and tuition-free college initiatives can alleviate some of the financial burdens on middle-class families.

4. Financial Literacy

Improved financial literacy can empower individuals to make better decisions about budgeting, saving, and investing. Community workshops, online courses, and employer-sponsored programs can make a significant difference.

5. Strengthening Unions

Labor unions can advocate for fair wages, better working conditions, and benefits that support middle-class families. Strengthening unions could help bridge the gap between productivity and wages.

The Broader Implications of the Middle-Class Trap

The erosion of the middle class has profound implications for society as a whole. A thriving middle class drives economic growth, fosters innovation, and ensures political stability. When the middle class struggles, the consequences ripple across all sectors:

Economic Stagnation: A weakened middle class reduces consumer spending, slowing economic growth.

Social Inequality: The gap between the rich and the poor widens, leading to social unrest and a breakdown in community cohesion.

Political Polarization: Economic struggles can fuel political extremism, as disenfranchised individuals seek solutions to their grievances.

Conclusion

The middle-class trap is a stark reminder that hard work alone is no longer enough to guarantee success. Stagnant wages, rising taxes, and escalating living costs have created a system where financial stability is increasingly out of reach for many. However, with the right mix of policy changes, community support, and individual empowerment, it is possible to break free from this cycle.

As we move forward, it is essential to recognize the value of a robust middle class and work collectively to restore the promise of upward mobility. Only then can we ensure that the dream of success through hard work remains attainable for future generations.

Our GST Services

All E-commerce Tax services

E-commerce tax services help online sellers navigate GST registration, compliance, return filing, TCS management, tax planning, and audits, ensuring efficient tax management and legal compliance.

GST Filing

GST filing is the process of submitting tax returns to the government, detailing sales, purchases, and taxes paid or collected, ensuring compliance with GST laws.

GST Registration

GST registration is the process where businesses obtain a GSTIN from the government, allowing them to collect taxes, claim input tax credits, and comply with GST laws.