Online IEC Services

- Hassle-Free Registration:

Simple and efficient process to obtain your Import Export Code with expert guidance.

- Quick Processing:

Fast approval and issuance of IEC, ensuring you can start international trade without delays.

- Comprehensive Support:

Full assistance with documentation and compliance, ensuring a smooth application process and future updates.

Our Client Google Reviews

Overview of IEC Services

The Import Export Code (IEC) is a mandatory 10-digit identification number required for businesses engaged in importing or exporting goods and services in India. Issued by the Directorate General of Foreign Trade (DGFT), the IEC is a one-time registration that is essential for starting international trade.

Key Aspects of IEC:

- Requirement for Imports & Exports: IEC is necessary for businesses to import goods into India or export goods and services abroad. Without it, customs clearance cannot be done.

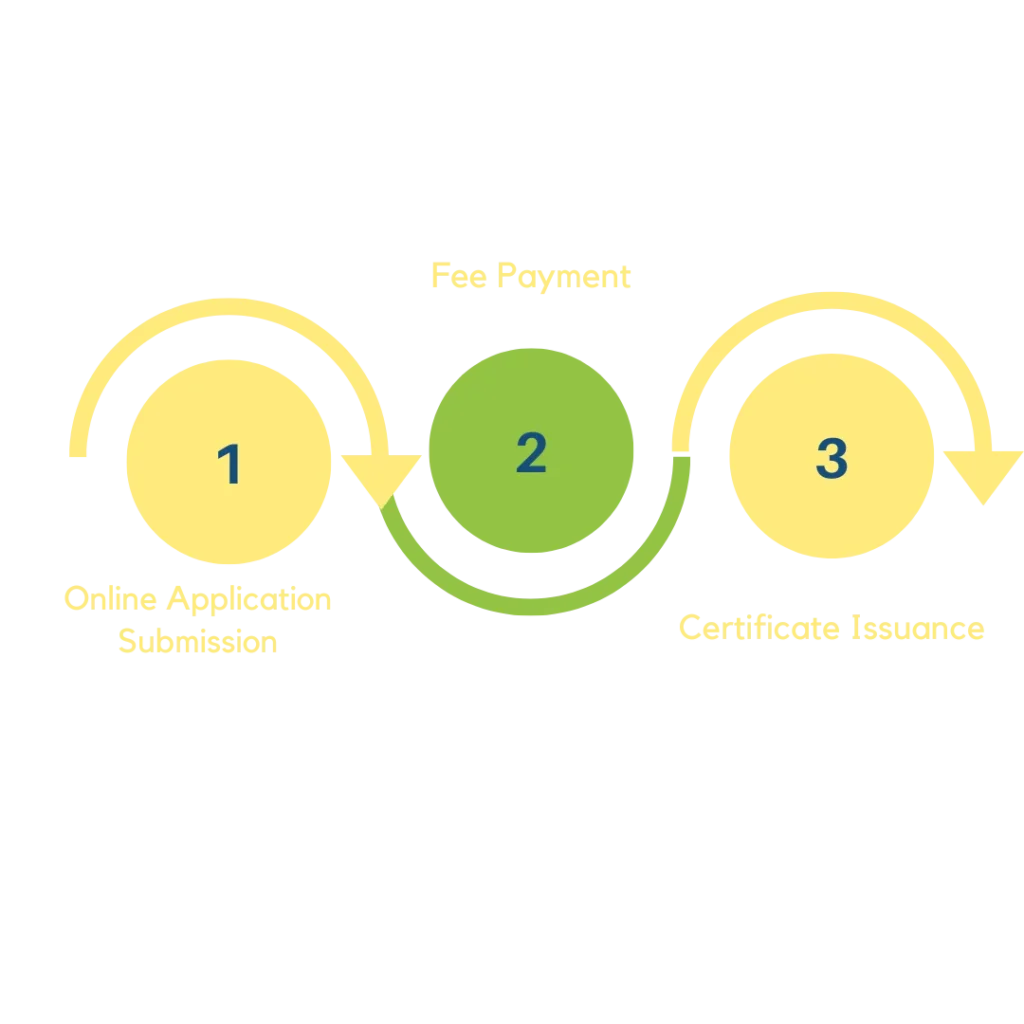

- Simple Application Process: Businesses can apply for IEC online through the DGFT portal, and the process typically requires basic documents like PAN, proof of address, and bank details.

- Lifetime Validity: Once issued, the IEC is valid for the lifetime of the business and does not require renewal, though updates may be necessary in case of changes to the business information.

The IEC also facilitates benefits under government trade policies, and without it, businesses may miss out on various incentives.

Why Taxamicus for IEC Service?

Expert Guidance

Get professional assistance to ensure error-free and smooth application for your Import Export Code.

Fast Processing

Speedy application handling to get your IEC quickly and avoid delays in starting international trade.

Hassle-Free Experience

We manage the entire process, from documentation to submission, so you don’t have to worry about complexities.

Lifetime Support

Once your IEC is issued, we provide ongoing support for any updates or modifications you may need.

Our GST IEC Services

Requited Documents for IEC

- PAN Card (of the individual or business entity)

- Proof of Address (Business address proof such as utility bills, lease agreement, or a bank statement)

- Bank Account Details (Cancelled cheque or bank certificate with the business’s bank account number and IFSC code)

- Business Entity Proof (For companies or partnerships: Certificate of Incorporation, Partnership Deed, or LLP Agreement)

- Digital Signature (Class 2 or Class 3 DSC may be required for authentication)

- Passport- size Photo/Photos

- Mobile number & Email id

FAQ

IEC (Import Export Code) is a 10-digit code issued by the DGFT, required for businesses engaged in importing or exporting goods and services in India.

Any individual or business involved in international trade, whether importing or exporting, must obtain an IEC.

Yes, IEC is mandatory for businesses that import or export goods or services. Without IEC, customs clearance cannot be processed.

IEC is valid for a lifetime and does not require renewal. However, it must be updated if there are changes in business details.

Common documents include a copy of the PAN card, proof of business address, and bank account details (like a cancelled cheque or bank certificate).

Yes, the IEC application process is fully online via the DGFT portal.

Typically, IEC can be issued within 2-3 working days after successful submission of the application and payment of fees.

Yes, there is a government fee payable at the time of application, which can be paid online during the filing process.

Yes, if a business no longer needs an IEC, it can apply for cancellation or surrender the code through the DGFT portal.

Yes, changes like business name, address, or bank details can be updated in the IEC via the DGFT portal by filing the modification request.