Latest Government Notifications and News For GST

25th March 2025

IndusInd Bank shares down 5%

IndusInd Bank shares down 5% on selling pressure after Rs 30 crore penalty over ‘various GST issues’

10th January 2024

Advisory on Extension of Due Date

Due Date for filling of GSTR-1 and GSTR-3B have been extended by two days.

8th December 2024

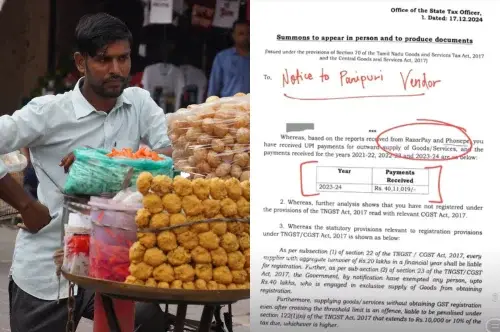

Pani puri vendor receives GST notice

Pani puri vendor hit with GST notice for ₹40 lakh in transactions sparks online buzz with "career change" jokes.

1st January 2024

GST Turnover for December 2024

Gross and Net GST revenue collections for the month of Dec, 2024

29th December 2024

Waiver Scheme

Advisory for Waiver Scheme under Section 128A

24th December 2024

GSTR-9 Due date

GSTR-9 Due Date on 31st December

24th December 2024

GST on Cars

GST Hike on sale of used Cars

24th December 2024

GST on Popcorn

How to tax popcorn? GST council’s formula sparks outrage

24th December 2024

GST changes on EV

GST on loss margin of EV

21th December 2024

GST Council Meeting

Latest GST Council Meeting: Key Highlights and Tax Updates

19th December 2024

Relief to Infosys

Relief to Infosys on GST demand likely to take longer amid law panel mulling over options

18th December 2024

Tax cut on health, life insurance policies

Tax cut on health, life insurance policies part of GST Council's agenda for 21st December meet

17th December 2024

E-Way Bill and E-Invoice

Advisory on Updates to E-Way Bill and E-Invoice Systems

16th December 2024

GST Council May Slash Taxes

GST Council May Slash Tax On Online Food Delivery Charges To 5%: Report

16th December 2024

GST Council may increase tax

GST Council may increase tax on old and used vehicles, including EVs, to 18%

27th November 2024

Biometric-Based Aadhaar Authentication Part - ii

Advisory for Biometric-Based Aadhaar Authentication and Document Verification for GST Registration

12th December 2024

Zomato to pay Rs 800CR

GST department asks Zomato to pay Rs 800 crore in taxes, fines

25th March 2025

IndusInd Bank shares down 5%

IndusInd Bank shares down 5% on selling pressure after Rs 30 crore penalty over ‘various GST issues’

9th December 2024

Annual Returns FY 23-24

Advisory on difference in value of Table 8A and 8C of Annual Returns FY 23-24

8th December 2024

Biometric-Based Aadhaar Authentication

Advisory for Biometric-Based Aadhaar Authentication and Document Verification for GST Registration

1th December 2024

Gross and Net GST revenue

Gross and Net GST revenue collections for the month of Nov, 2024

Latest Government Notifications and News For ITR

31th December 2024

ITR Filing Deadline Extended

Income Tax Department extends belated, revised ITR filing deadline to January 15, 2025 for these taxpayers

18th December 2024

Disclose Foreign asset of income details

Disclose Foreign asset of income details in ITR by 31st Dec 2024 or else Rs10 Lakh Penalty can apply, says Income Tax Department.

15th December 2024

ITR advance tax deadline today

ITR advance tax deadline today: Who all should pay these taxes? All you need to know

6th December 2024

Notice Inviting Tender (NIT)

Notice Inviting Tender (NIT) for selection of Managed Service Provider (MSP) for Insight 2.0.

4th December 2024

Form 3CEFA

Form 3CEFA (Application for Opting for Safe Harbour) are now available for filing on the e-filing portal. Please refer notification by CBDT vide notification no 124/2024

30th November 2024

The due date for filing returns

The due date for filing returns under section 139(1) of the Income Tax Act, 1961 has been extended from 30th November 2024 to 15th December 2024

Our Services-

GST Filing

GST filing is the process of submitting tax returns to the government, detailing sales, purchases, and taxes paid or collected, ensuring compliance with GST laws.

ITR Filing

ITR Filing services provide full assistance with Income Tax Return submissions, ensuring accurate and timely compliance with all tax regulations and statutory requirements for both individuals and businesses.

GST Registration

GST registration is the process where businesses obtain a GSTIN from the government, allowing them to collect taxes, claim input tax credits, and comply with GST laws.