GST vs. Old Tax System: Which One Is Better for Consumers?

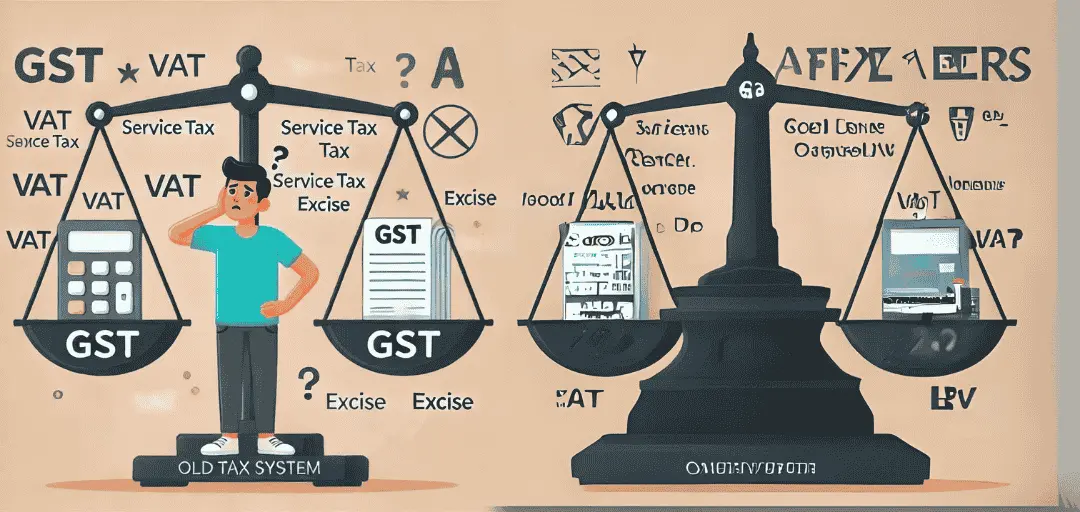

Taxation plays a crucial role in shaping a country’s economy, influencing everything from business operations to consumer spending. In India, the introduction of the Goods and Services Tax (GST) in 2017 marked one of the most significant tax reforms in the country’s history. Replacing multiple indirect taxes with a single, unified tax, the GST tax system was designed to simplify compliance, eliminate cascading taxation, and promote economic efficiency. However, consumers have had mixed experiences under GST compared to the old tax system.

This blog explores the key differences between GST and the pre-GST tax regime, analyzing how they impact consumers and whether GST tax has indeed brought more benefits than drawbacks.

Understanding the Old Tax System

Before the implementation of GST tax, the Indian taxation system was complex, consisting of multiple layers of indirect taxes levied by both the central and state governments. These included:

- Value Added Tax (VAT): Levied on the sale of goods at the state level, with varying rates across states.

- Service Tax: Applied to services at a fixed percentage.

- Excise Duty: Charged on the manufacturing of goods.

- Octroi and Entry Tax: Imposed on goods moving across state borders.

- Luxury Tax and Entertainment Tax: Applied to luxury goods and services.

One of the major issues with this system was the cascading effect, where tax was paid on tax, increasing the overall cost of goods and services for consumers.

How GST Tax Replaced the Old System

GST tax was introduced to eliminate these inefficiencies by unifying the indirect tax structure under a single tax. It brought together multiple state and central taxes into a single framework, ensuring seamless credit flow across supply chains.

Impact on Consumers: GST vs. Old Tax System

1. Transparency and Simplification

- Old Tax System: Consumers often faced confusion due to the multiple tax rates on the same product in different states.

- GST Tax: Offers uniform taxation across states, making it easier for consumers to understand pricing structures.

2. Tax Burden and Pricing

- Old Tax System: Due to the cascading tax effect, final prices of goods were inflated.

- GST Tax: Eliminates cascading taxes through the input tax credit mechanism, theoretically lowering costs for consumers. However, not all price reductions have been passed on to consumers.

3. Inflation and Initial Price Hike

- Old Tax System: Consumers were accustomed to different tax rates depending on the state and product.

- GST Tax: Initially led to price hikes in many sectors due to the restructuring of tax rates, but prices stabilized over time.

4. Impact on Essential vs. Luxury Goods

- Old Tax System: Essentials like food were taxed at lower rates, but variations existed across states.

- GST Tax: Categorized goods into tax slabs (0%, 5%, 12%, 18%, and 28%), ensuring a systematic tax approach. Essential goods remain in the lower brackets, while luxury items are taxed higher.

5. Online Shopping and E-commerce

- Old Tax System: E-commerce companies had to comply with multiple state taxes, leading to inconsistencies in pricing.

- GST Tax: Standardized taxation across states has simplified online shopping and made it more consumer-friendly.

6. Service Sector Impact

- Old Tax System: Service tax was capped at 15%.

- GST Tax: Most services now attract 18% GST, leading to higher costs for consumers in sectors such as banking, insurance, and telecom.

7. Restaurant Bills and Dining Out

- Old Tax System: Multiple taxes were applied, often confusing consumers about the actual tax being paid.

- GST Tax: Standardized tax rates (5%, 12%, or 18%), providing more transparency. However, consumers have mixed reactions, as some restaurant bills have increased.

8. Fuel and Electricity Exclusion

- Old Tax System: State and central taxes applied separately to fuel and electricity.

- GST Tax: These sectors remain outside the GST framework, leading to continued price fluctuations for consumers.

Challenges Faced by Consumers Under GST Tax

While GST tax has streamlined taxation, certain challenges remain for consumers:

- Increased Costs in Some Sectors: Services such as banking and insurance have seen higher tax rates, impacting affordability.

- Confusion Over Tax Slabs: The existence of multiple tax slabs creates confusion about why some items fall into higher tax brackets.

- Lack of Reduction in Prices: Despite the removal of cascading taxes, consumers have not always benefited from price reductions, as businesses have not consistently passed on savings.

- Frequent Policy Changes: Continuous modifications in GST rates and compliance requirements make it difficult for consumers to keep track.

Benefits of GST Tax for Consumers

Despite the challenges, there are notable benefits for consumers under GST tax:

- Uniform Pricing: Goods and services are taxed consistently across states, preventing discrepancies.

- Lower Prices for Certain Goods: Many household and daily-use items are now taxed lower compared to the old system.

- Improved Business Efficiency: A streamlined tax system helps businesses reduce costs, which can translate into consumer savings.

- Ease of Doing Business: With a single tax structure, companies can focus more on quality and pricing rather than tax compliance.

Final Verdict: Which is Better for Consumers?

The answer depends on various factors. The GST tax system has undoubtedly removed many inefficiencies of the old tax system and brought in more transparency. However, the impact varies across different consumer segments.

- For middle-class consumers: The GST tax system has been a mixed bag, with some essential goods becoming cheaper but services like banking and insurance becoming more expensive.

- For luxury consumers: The higher tax rates on luxury goods have increased costs, discouraging excessive spending.

- For small-scale consumers: While daily-use goods have seen stable pricing, the indirect impact of higher service sector costs is felt in banking, transport, and telecom services.

Conclusion

GST tax has undoubtedly reformed the Indian tax system, bringing transparency and efficiency. While it has simplified tax compliance, its direct impact on consumers has been both beneficial and challenging.

For consumers, the advantages of uniform pricing, elimination of cascading taxes, and improved business efficiency are significant. However, higher taxes on services, exclusions like fuel and electricity, and price fluctuations remain concerns.

Over time, as GST tax continues to evolve, its effectiveness in benefiting consumers will largely depend on future reforms, rate rationalization, and ensuring that businesses pass on the cost benefits to end-users.

Our GST Services For E-commerce Sellers

All E-commerce Tax services

E-commerce tax services help online sellers navigate GST registration, compliance, return filing, TCS management, tax planning, and audits, ensuring efficient tax management and legal compliance.

GST Filing

GST filing is the process of submitting tax returns to the government, detailing sales, purchases, and taxes paid or collected, ensuring compliance with GST laws.

GST Registration

GST registration is the process where businesses obtain a GSTIN from the government, allowing them to collect taxes, claim input tax credits, and comply with GST laws.