GST Registration for |

Frustrated with the lengthy GST registration process? Taxamicus simplifies it for you with fast and hassle-free GST registration with the help of our expert guidance anywhere in India!

- Successfully registered 5,000+ GST accounts for businesses

- Get expert guidance from our GST registration consultants

4270+

Happy Clients

99.2%

Filing Accuracy

14+ yrs

Of Experience

Free Consultancy By Expert

GST Registration in India – An Overview

GST (Goods and Services Tax) is a unified tax system in India that replaces multiple indirect taxes. It simplifies the taxation process by consolidating taxes like VAT, service tax, and excise into one. Businesses with a turnover above a certain threshold must register for GST, obtaining a unique GSTIN. Registration ensures compliance with GST laws, allowing businesses to collect taxes, claim input tax credits, and legally trade across states. It improves transparency, boosts business credibility, and promotes ease of doing business in India. Understanding the correct GST registration is crucial for smooth operations and avoiding penalties.

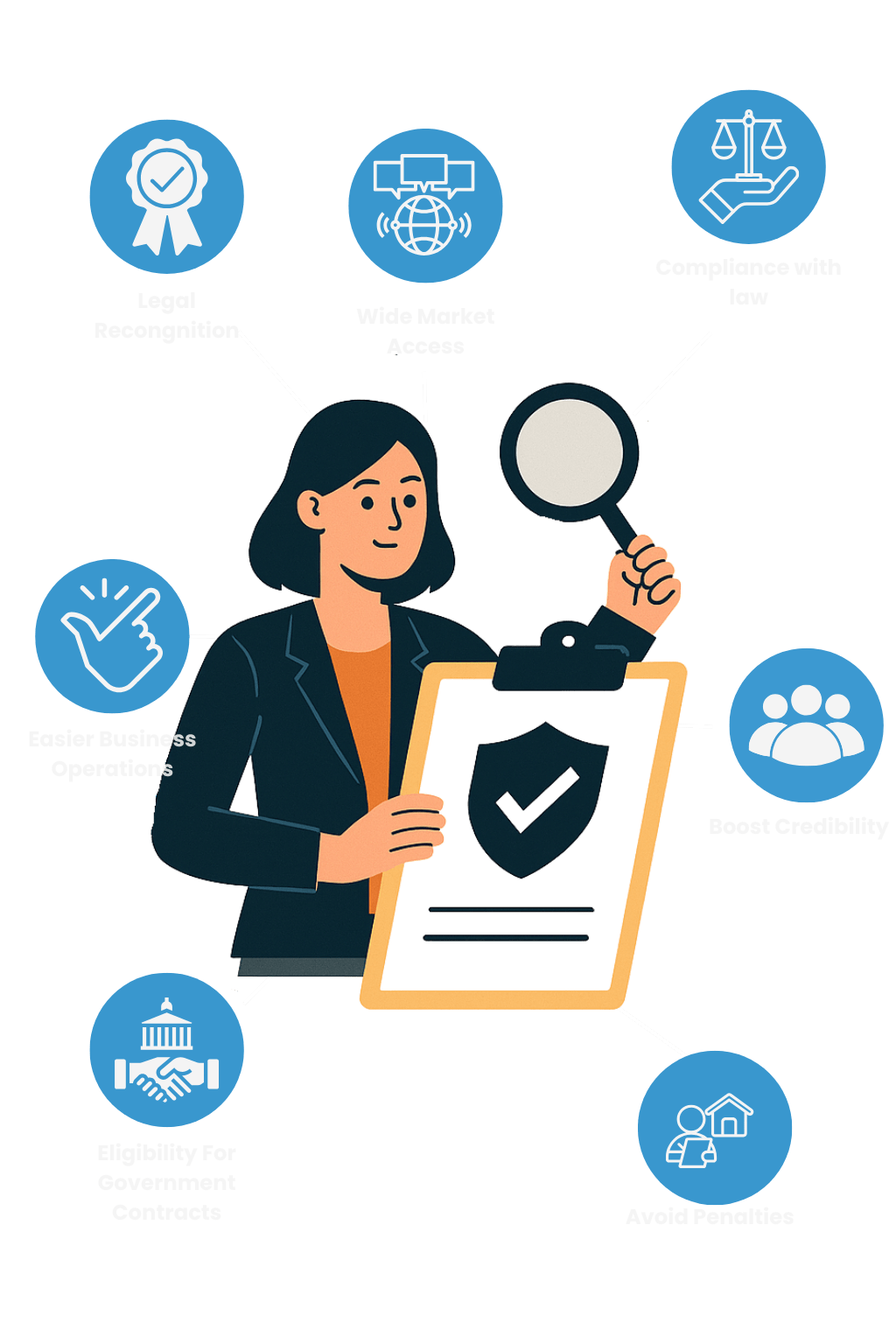

GST Registration Benefits.

Legal Recognition

Your business becomes legally recognized as a supplier of goods or services under GST law.

Input Tax Credit (ITC)

You can claim credit for GST paid on purchases, reducing overall tax liability.

Wider Market Access

GST registration enables seamless trade across states and online platforms like Amazon, Flipkart, etc.

Improved Compliance Rating

Being registered helps maintain a good GST compliance score, which builds business credibility.

Bank Loans & Tenders

GST registration is often required for applying for business loans or participating in government tenders.

Avoid Penalties

Operating without required registration can attract heavy fines and legal action.

Explain Voluntary GST Registration

Voluntary GST Registration refers to the option for businesses or individuals to register under GST even if their annual turnover is below the mandatory threshold limit (₹20 lakh for service providers and ₹40 lakh for goods suppliers in most states).

Why opt for Voluntary GST Registration?

Input Tax Credit (ITC) Eligibility

Registered businesses can claim input tax credit on their purchases, reducing their overall tax liability.

Improved Business Credibility

A GST-registered business is often preferred by B2B clients, marketplaces (like Amazon, Flipkart), and government tenders—especially useful for e-commerce sellers, like those your firm Taxamicus supports.

Legal Recognition

It provides a legally compliant identity which helps in smooth inter-state transactions and business expansion.

Avoid Cascading Tax

Without GST, taxes get embedded into costs at multiple levels. Voluntary registration helps avoid this by making tax credit transparent.

Though not compulsory, voluntary GST registration can be a strategic move for small or growing businesses aiming for wider reach and professionalism.

Who Needs GST Registration?

Threshold

₹40 lakhs for goods (₹20 lakhs for services) in most states.

Voluntary Registration

Optional registration to claim ITC and boost credibility.

Inter-State Suppliers

Anyone supplying goods or services across states, regardless of turnover.

E-commerce Sellers

Selling through Amazon, Flipkart, etc., requires GST registration.

Casual & Non-Resident Suppliers

Occasional or foreign suppliers doing business in India.

Reverse Charge Applicability

If liable to pay GST under reverse charge mechanism.

Input Service Distributors (ISD)

Companies that distribute tax credit among branches.

Agents Supplying on Behalf of Others

Requited Documents for GST Registration

For Individuals:

- PAN Card

- Rent Agreement Or NOC

- Aadhaar Card

- Electricity bill/ Tax Reciept

- Bank Statement/ Cancelled cheque

- Passport- size Photo

- Mobile number & Email id

- List you documents you want to sell

For Partnerships

- PAN Card of Firm

- Partnership Deed

- Passport-size Photo

- Mobile number & Email id.

- Rent agreement & Electricity bill

- PAN and Aadhaar card of all P

- Bank Statement/Cancelled Cheque

- Liist you Goods you want to sell.

For Companies

- Certificate of Incorporation

- PAN Card Companies

- Mobile number & Email id

- Passport-size Photo

- MOA and AOA

- PAN and Aadhaar of all Directors

- Bank Statement/Cancelled Cheque

- List of Goods you want to sell.

For Trusts/Societies

- PAN Card of trust/society

- Trust Deed/By-laws

- Mobile number & Email id

- Passport-size Photo

- PAN and Aadhaar Card of All M

- Utility bill & Rent agreement

- Bank Statement/ Canceled Cheque

- List of Goods you want to sell

Additional Documents (IF Applicable)

- GST Registration Certificate: For businesses with multiple branches.

- Digital Signature: Required for companies and LLPs.

- Any Additional documents if Requited.

Step by Step GST Registration.

Violations & Non-Compliance and Penalty & Offences

Violations & Non-Compliance

Not Registering Under GST

Failure to register when required can lead to penalties.

Delayed Filing of Returns

Attracts late fees and interest on unpaid tax.

Wrongful ITC Claim

Claiming Input Tax Credit without actual purchases is a punishable offense.

Issuing Fake Invoices

Generating invoices without real transactions can result in heavy fines or prosecution.

Non-Payment of Tax Collected

Collecting GST but not depositing it with the government is a serious violation.

Supplying Goods Without Invoice

Leads to tax evasion charges and seizure of goods.

Obstructing GST Officers

Non-cooperation during audits or investigations is also punishable.

Penalty & Offence

Not Registering for GST

Penalty: ₹10,000 or 100% of tax due (whichever is higher)

Incorrect Invoice or False Information

Penalty: ₹10,000 or higher based on severity

Collecting GST Without Registration

Offence: Illegal – full tax amount + penalty

Wrongful ITC Claim or Refund Fraud

Penalty: 100% of amount involved + prosecution in severe cases

Failure to File Returns

Late fee: ₹50 per day (₹20/day for nil return) + interest on tax

Repeated Offences

Up to ₹25,000 fine or arrest in fraud cases over ₹5 crore

Obstructing GST Officer or Tampering with Evidence

Penalty: ₹25,000 + possible prosecution for serious interference or fraud

Different types of GST Registration

Post Registration Compliance for GST Registration.

Display of GSTIN

The GST Identification Number (GSTIN) must be displayed at the business premises and on all invoices.

Issuing GST-Compliant Invoices

All invoices must follow the prescribed format and include GSTIN, HSN/SAC codes, tax rate, and breakup of CGST/SGST/IGST.

Filing of Returns

Regular filing of GST returns (monthly/quarterly/annually) is mandatory as per the type of registration (e.g., GSTR-1, GSTR-3B, GSTR-9).

Maintaining Books of Accounts

Businesses must maintain detailed records of all purchases, sales, input tax credit, and stock.

Updating Business Details

Any change in address, business name, or nature of business must be updated through an amendment application.

Reconciliation of ITC

Input tax credit claimed must match the details uploaded by suppliers (via GSTR-2A/2B); discrepancies must be resolved.

Timely Payment of Tax

GST dues must be paid before filing returns to avoid interest and penalties.

Letter of Undertaking (LUT)

Exporters must file an LUT annually to export goods or services without paying IGST.

GST Audit (If Applicable)

Businesses with turnover exceeding the prescribed limit must get their accounts audited by a Chartered Accountant or Cost Accountant under GST law.

Features of GST Registration.

Legal Recognition

GST Registration grants legal identity to the business, enabling it to operate under the GST regime.

Wider Market Access

GST Registration allows businesses to expand to other states and increase sales opportunities.

Compliance with Law

It ensures adherence to government tax laws, avoiding penalties and legal issues.

Boosts Credibility

A GST-registered business gains trust from customers and vendors, enhancing brand image.

Easier Business Operations

GST Registration simplifies intra-state and inter-state transactions and allows for smooth supply chain management.

Avoids Penalties

Registration ensures that businesses comply with tax filing deadlines, avoiding fines and interest.

Eligibility for Government Contracts

Many government contracts and tenders require businesses to be GST-registered.

Difference between Normal Taxpayer and Composition Scheme Taxpayer

| Aspect | Normal Taxpayer | Composition Scheme Taxpayer |

|---|---|---|

| Tax Rates | Standard GST rates (5%, 12%, 18%, 28%) | Lower fixed rates (e.g., 1%, 5%) |

| Input Tax Credit | Can claim input tax credit | Cannot claim input tax credit |

| Return Filing | Monthly/Quarterly + Annual | Quarterly + Annual |

| Invoice Type | Tax invoice with GST mentioned | Bill of supply (no GST shown) |

| Eligibility | Open to all businesses | Turnover up to ₹1.5 crore (₹75 lakh in NE states) |

| Compliance | Higher compliance requirements | Lower compliance burden |

| Supply Type | Can do inter-state supply | Only intra-state supply allowed |

| Customer Type | Suitable for B2B & B2C | More suitable for B2C (retail/local) |

How Taxamicus Helps Simplify the GST Registration Process

Expert-Led Registration

Get your GST registration handled by qualified tax professionals, ensuring zero errors and quick approvals.

Tailored Support for Every Business

Whether you're a startup, small trader, or e-commerce seller, we provide personalized assistance for your unique needs.

Hassle-Free & Online Process

Complete the entire registration from the comfort of your home—no paperwork hassles or office visits.

Post-Registration Compliance

We don’t stop at registration—we assist with return filing, invoice setup, ITC claims, and more.

Transparent Pricing

No hidden charges—just honest, upfront service at affordable rates.

Trusted by 10,000+ Clients

Our growing client base across India reflects our commitment to accuracy, speed, and service.

Faqs for GST Registration.

What is GST Registration?

GST registration is the process by which a taxpayer gets registered under Goods and Services Tax in India.

Who needs to register for GST?

Any business with an annual turnover above ₹40 lakhs (₹20 lakhs for services) must register. Lower thresholds apply in some states.

Is GST registration mandatory for online sellers?

Yes, e-commerce sellers must register for GST, regardless of turnover.

Can I apply for GST voluntarily?

Yes, any business can opt for voluntary GST registration to avail input tax credit and enhance credibility.

What are the types of GST registrations?

Regular, Composition Scheme, Casual Taxable Person, Non-Resident Taxable Person, ISD, and E-commerce Operator.

What documents are required for GST registration?

PAN, Aadhaar, proof of business address, bank details, and business constitution documents.

How long does GST registration take?

Usually 3–7 working days if all documents are correct and verified.

Is GST registration free of cost?

There’s no government fee, but professional assistance may involve a service charge.

Can I have multiple GST registrations?

Yes, for each state where the business operates, a separate GSTIN is required.

What is GSTIN?

GSTIN (Goods and Services Tax Identification Number) is a unique 15-digit code assigned to each registered taxpayer.

Can I operate without GST registration?

No, doing taxable business without registration is illegal and attracts penalties.

Do I need GST registration if I deal in exempted goods?

No, if your entire supply is exempt under GST, registration is not required.

What is the penalty for not registering under GST?

A minimum of ₹10,000 or 10% of tax due, whichever is higher.

How can I check my GST registration status?

On the official GST portal using your ARN (Application Reference Number).

Can I cancel my GST registration?

Yes, you can voluntarily cancel it if you are no longer liable to pay tax.

Is Aadhaar authentication mandatory for GST registration?

Yes, for individuals and proprietors, Aadhaar authentication speeds up the process.

What is the validity of GST registration?

For regular taxpayers, it’s valid until cancelled; for casual and non-resident taxpayers, it has a limited period.

Can I amend my GST registration?

Yes, changes in business name, address, or structure must be updated on the GST portal.

Is a physical verification required for GST registration?

Not always. It may be required if documents or Aadhaar are not verified online.

What happens after GST registration?

You must file GST returns regularly and display your GSTIN at your business premises.

What is the Composition Scheme under GST?

A simplified tax scheme for small businesses with lower compliance and flat tax rates.

Do freelancers or consultants need GST registration?

Yes, if their turnover exceeds the threshold or they wish to register voluntarily.

Can I apply for GST without a business premises?

A valid business address is required. Home-based businesses can use residential address with proof.

What is ARN in GST?

Application Reference Number – received after successful submission of GST registration form.

Why choose Taxamicus for GST Registration?

Taxamicus provides expert assistance, quick processing, document support, and end-to-end compliance solutions.