GST on Educational Services: What Is Exempt & What Is Taxable?

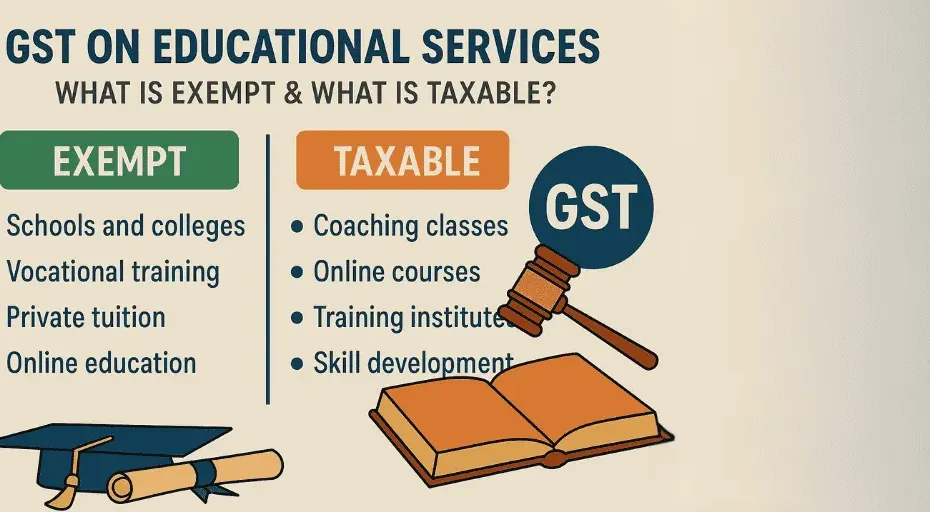

India’s Goods and Services Tax (GST) framework was introduced to bring uniformity in taxation across sectors. One area that has sparked both interest and confusion is the application of GST on educational services. Education, being a socially critical sector, has been treated with care under the GST regime. However, not all educational services are exempt. While some are fully exempted to promote accessibility, others—especially those with commercial or skill-based orientations—attract GST.

This blog explores GST on educational services in detail, helping institutions, educators, and learners understand what is exempt and what is taxable under the law.

Understanding Educational Services Under GST

The term “educational services” under GST includes services provided by:

Schools

Colleges

Universities

Institutions providing education as part of a curriculum recognized by law

However, GST on educational services is applied differently depending on the type and nature of the service. The government has made a clear distinction between core education and auxiliary or commercial services.

GST Exemptions for Educational Services

Let’s begin with what is exempt from GST. The goal of the government is to ensure that basic education remains accessible and affordable.

1. Educational Institutions Offering Recognized Qualifications

If a school, college, or university is offering courses that lead to a qualification recognized by law, the services provided are exempt under GST. This includes:

Pre-school education

Primary to higher secondary education

Degree or diploma courses recognized by statutory bodies

2. Vocational and Skill Development Training

Programs recognized by the National Skill Development Corporation (NSDC) or sector-specific councils are also exempt. These courses are aimed at improving employability.

3. Services to Educational Institutions

Some services provided to educational institutions are also exempt, such as:

Transportation of students and staff

Catering (including mid-day meals sponsored by the government)

Security and housekeeping

Admission-related services

These exemptions aim to reduce the cost burden on core education providers and beneficiaries.

Taxable Educational Services Under GST

Not all education-related services are exempt. Many services that fall outside formal or recognized education are considered taxable under GST.

1. Coaching and Tuition Centers

Private coaching classes, test-prep centers (like IIT-JEE or NEET coaching), and tuition centers are taxable at 18% GST. These institutions are considered commercial and don’t provide education as per a recognized curriculum.

2. Online Courses and E-Learning Platforms

The booming ed-tech sector comes under the purview of GST. Most online educational services provided by private players are taxable at 18%, unless they are affiliated with a recognized board or institution.

3. Commercial Training and Certification Programs

Programs that offer certifications without statutory recognition or aren’t aligned with NSDC guidelines are subject to GST. This includes training in photography, digital marketing, design, and others offered by private institutions.

4. Education Consultancy Services

Overseas education consultancies or agencies that assist with applications, visa services, or admission counseling are also subject to GST at applicable rates.

Clarification by CBIC on Educational Services

The Central Board of Indirect Taxes and Customs (CBIC) has issued several clarifications on gst on educational services, confirming that only those services leading to a qualification recognized by law are eligible for exemption.

For example:

A school hiring transport services for students is exempt.

A coaching institute using the same transport service is not exempt.

A college offering distance learning degrees approved by UGC is exempt.

A private online course not affiliated with any statutory body is taxable.

Composite and Mixed Supply Considerations

When educational institutions offer bundled services, classification becomes important:

Composite Supply: If a school charges a single fee for education, meals, and transport, and education is the principal supply, then the entire service may remain exempt.

Mixed Supply: If separate charges are applied for additional services like adventure camps or language labs, these may attract GST.

Educational institutions must carefully assess such bundled services to avoid non-compliance.

Input Tax Credit (ITC) for Educational Institutions

Institutions providing exempt educational services cannot avail Input Tax Credit (ITC) on inputs like printing, classroom infrastructure, or equipment. However, if an institution provides both exempt and taxable services, such as offering coaching alongside formal degree programs, they can claim proportionate ITC only on the taxable side.

This often results in increased cost of operations for coaching and training providers who are not exempt under GST.

Registration Requirements

All providers of taxable educational services, like online platforms, coaching centers, and consultancies, are required to register under GST if their annual turnover exceeds the threshold limit (₹20 lakh for most states, ₹10 lakh for special category states). Failure to register may attract penalties.

Case Studies: Exempt vs. Taxable Scenarios

Let’s look at a few practical examples to understand how GST on educational services is applied:

Case 1: A CBSE-affiliated school provides education and also runs a music academy. The school is exempt, but the music academy must charge GST if not part of the recognized curriculum.

Case 2: An ed-tech company offers online coding courses for kids. If these courses are not affiliated with a board or government-recognized institution, they are taxable.

Case 3: A college hires a private caterer to run a cafeteria. This service is not exempt and will be taxable, though the core educational service remains tax-free.

Compliance Tips for Educational Service Providers

Identify the Nature of Service: Clearly classify whether your service falls under recognized education or not.

Check GST Registration Status: If taxable, ensure timely registration to avoid penalties.

Issue GST-Compliant Invoices: Particularly for coaching and online courses.

Review Input Tax Credit Eligibility: Segregate taxable and exempt services.

Maintain Clear Documentation: Especially for composite or mixed services.

Conclusion

Navigating GST on educational services requires a nuanced understanding of the distinction between formal education and commercial training. While the government has rightly exempted services that promote inclusive education, institutions offering skill development, online courses, and consultancy must comply with the applicable GST regulations.

Understanding what qualifies as exempt and what is taxable can help educational service providers manage their tax obligations better and avoid costly compliance errors.

Our GST Services

All E-commerce Tax services

E-commerce tax services help online sellers navigate GST registration, compliance, return filing, TCS management, tax planning, and audits, ensuring efficient tax management and legal compliance.

GST Filing

GST filing is the process of submitting tax returns to the government, detailing sales, purchases, and taxes paid or collected, ensuring compliance with GST laws.

GST Registration

GST registration is the process where businesses obtain a GSTIN from the government, allowing them to collect taxes, claim input tax credits, and comply with GST laws.