Every year, when the Union Budget is announced, middle-class families sit with hope. News headlines promise relief, growth, benefits, and support. Finance experts debate numbers, social media celebrates or criticizes, and governments highlight achievements.

But once the excitement settles, a crucial question remains unanswered for most households:

What do middle-class families actually get?

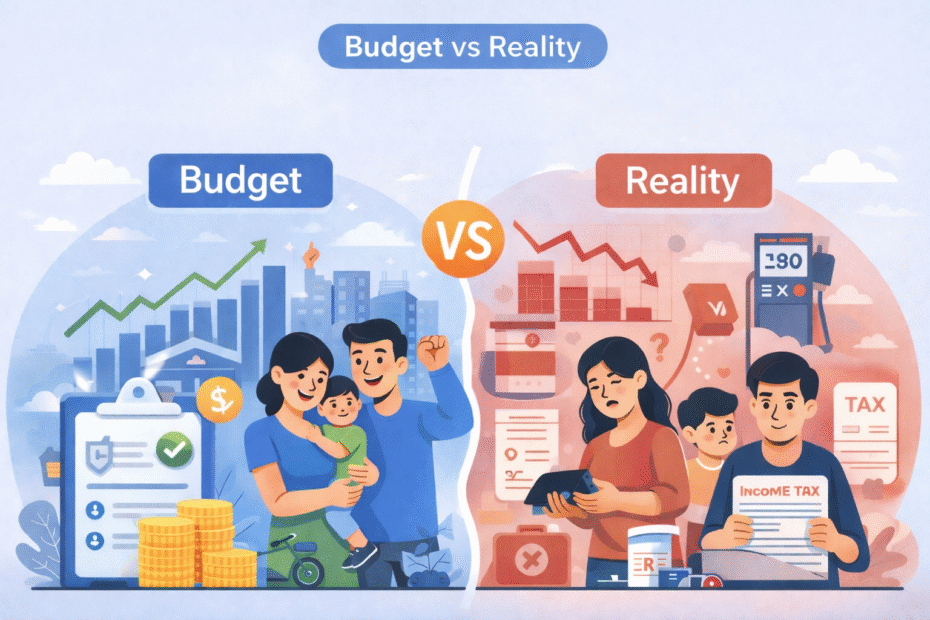

This gap between promises and lived experience is best explained by one phrase—Budget vs Reality.

In this blog, we break down the real impact of budgets on middle-class families, uncover hidden truths, and explain what taxpayers should realistically expect instead of what is advertised.

Who Are Middle-Class Families in India?

Before understanding Budget vs Reality, we must define the middle class.

Typically, middle-class families:

Earn between ₹3 lakh and ₹25 lakh annually

Rely mainly on salary or small business income

Pay income tax regularly

Have home loans, education expenses, medical costs

Aim for savings, insurance, and basic investments

Ironically, this group contributes the most consistent tax revenue but often receives the least visible benefit.

Budget Announcements: What Is Promised? (Budget vs Reality)

Every budget highlights:

Increased standard deduction

Changes in tax slabs

New schemes and incentives

Infrastructure development

Digital growth and ease of living

On paper, everything looks positive. This is where the Budget side of Budget vs Reality dominates the narrative.

Reality Check: What Middle-Class Families Experience

After budgets are implemented, families usually face:

Rising cost of living

Higher education and healthcare expenses

Increased indirect taxes

Reduced or removed deductions

Complex compliance rules

The real struggle begins when numbers on paper meet real household expenses.

Budget vs Reality: Income Tax Relief

Budget Claim

Tax slabs are revised. New tax regime is promoted as “simpler and beneficial”.

Reality

Most middle-class families lose deductions under the new tax regime

Tax savings are often offset by loss of exemptions

Inflation neutralizes tax relief

Higher income still means higher tax burden

In the Budget vs Reality comparison, tax relief often looks bigger than it actually is.

Standard Deduction: Relief or Illusion?

Budget Perspective

Standard deduction increases are projected as major relief.

Reality

Increase rarely matches inflation

Medical, education, and housing costs grow faster

Net disposable income barely improves

For most salaried families, this is symbolic relief, not financial comfort.

Indirect Taxes: The Silent Burden

One major reason Budget vs Reality feels unfair is indirect taxation.

Even if income tax remains stable:

GST on daily essentials affects everyone

Fuel prices impact transport and goods

Hidden taxes increase living costs

Middle-class families end up paying more without realizing it.

Education & Healthcare: The Biggest Reality Gap

Budget Announcements

Increased allocation for education and healthcare

New schemes and digital initiatives

Ground Reality

Private education costs continue rising

Healthcare expenses remain largely out-of-pocket

Insurance premiums increase every year

The Budget vs Reality gap is widest in these two essential areas.

Home Loans & Housing: Expectations vs Experience

Budget Side

Housing incentives

Affordable housing push

Interest deduction under Section 24

Reality Side

Property prices remain high

Interest deduction limits unchanged

EMI burden increases with interest rate changes

For middle-class families, owning a home still feels stressful rather than secure.

Savings & Investments: Are They Really Encouraged?

Budget Claims

Encouragement for long-term investments

Focus on financial discipline

Reality

Many tax-saving instruments offer low real returns

Inflation eats into savings

Middle-class families save less, not more

In the Budget vs Reality debate, savings are encouraged in theory but discouraged by economic pressure.

Why Middle-Class Families Feel Ignored

The middle class often feels:

Too rich for subsidies

Too poor for luxury benefits

Heavily taxed but lightly supported

This emotional disconnect fuels the Budget vs Reality discussion every year.

Is the New Tax Regime Really Better?

The new tax regime is a classic Budget vs Reality example.

Budget Narrative

Lower tax rates

Simpler structure

Reality

Loss of deductions

Less flexibility

Not suitable for families with loans, insurance, or dependents

For many middle-class taxpayers, the old regime still works better—but only with careful planning.

Compliance Burden: The Hidden Cost

Budgets promise simplification, but reality shows:

Frequent rule changes

Confusing tax updates

Increased reporting requirements

Time, stress, and professional fees add to the middle class’s financial burden.

Budget vs Reality for Small Family Businesses

Middle-class families running small businesses face:

Higher compliance costs

GST complexity

Limited real incentives

While budgets talk about MSME support, ground reality often says otherwise.

What Middle-Class Families Can Do Instead of Complaining

Understanding Budget vs Reality is important—but action matters more.

Smart Steps to Take

Choose tax regime after proper calculation

Plan deductions early in the year

Integrate tax planning with budgeting

Avoid relying only on budget announcements

Seek professional advice

A smart tax strategy matters more than budget headlines.

Role of Professional Tax Planning

Budgets are generic. Families are not.

Professional tax planning helps:

Optimize tax liability legally

Choose the right regime

Plan investments smartly

Avoid compliance errors

This bridges the gap between Budget vs Reality.

How Taxamicus.in Helps Middle-Class Families

At taxamicus.in, the focus is on:

Practical tax planning, not theory

Real savings, not headline relief

Personalized advice for families

Budget impact analysis

ITR and compliance support

We help families understand what the budget says vs what actually benefits them.

The Truth About Budget vs Reality

Budgets are not designed to solve individual problems. They create frameworks.

Reality depends on:

Your income structure

Family responsibilities

Loans and investments

Tax planning approach

Understanding this difference helps families make smarter financial decisions.

Conclusion

The debate of Budget vs Reality will continue every year. While budgets may promise relief, middle-class families must look beyond headlines and focus on personal financial planning.

Instead of waiting for budget miracles:

Plan smartly

Save strategically

Invest wisely

Seek expert guidance

That is how middle-class families can truly benefit—regardless of what the budget announces.Bud