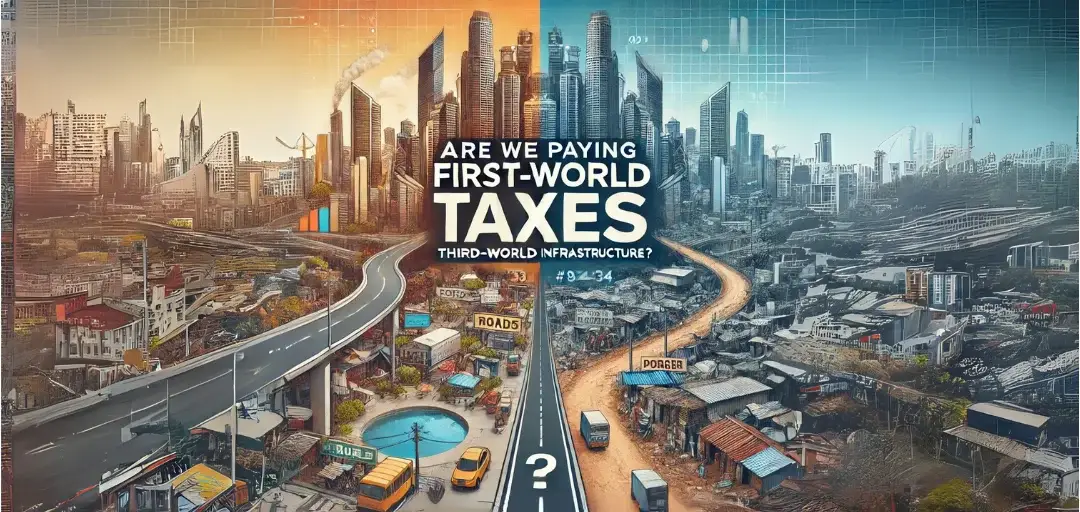

Are We Paying First-World Taxes for Third-World Infrastructure?

When citizens hand over a substantial portion of their hard-earned income to the government in the form of taxes, they naturally expect that money to translate into quality public services and robust infrastructure. However, in many countries, the reality is far removed from this expectation. This dichotomy raises a pressing question: Are we paying first-world taxes for third-world infrastructure? In this blog, we explore how taxation levels and public service quality compare across nations, unraveling why this discrepancy exists and what can be done to bridge the gap.

Understanding First-World Taxes and Third-World Infrastructure

The term “first-world taxes” refers to the high tax rates typically seen in developed nations. These taxes fund comprehensive public services like healthcare, education, transportation, and welfare programs. “Third-world infrastructure,” on the other hand, is a term that signifies poor roads, unreliable electricity, inadequate public healthcare, and other infrastructural deficits commonly associated with developing or underdeveloped nations.

When citizens of countries with middling or poor infrastructure pay taxes comparable to those in highly developed nations, the mismatch creates dissatisfaction and erodes trust in governance.

The Tax Burden on India’s Middle Class

India’s tax system often places a disproportionate burden on its middle class. This stems from several factors:

Limited Tax Base: Only about 6-7% of the population pays income tax, and the majority of this burden falls on the salaried middle class. Unlike the wealthy or businesses, they have limited avenues for tax optimization or evasion.

High Indirect Taxes: The Goods and Services Tax (GST), which applies to most goods and services, further impacts the middle class. While GST aims to be progressive, its regressive nature affects those who spend a larger portion of their income on essentials.

Lack of Social Security: Despite the taxes they pay, middle-class Indians do not receive benefits such as free healthcare, education, or robust social security that citizens in developed nations enjoy.

These factors make many wonder whether they are paying first-world taxes for third-world infrastructure.

Comparing Taxation and Infrastructure in Key Nations

Taxation levels vary significantly across the globe. Examining some key nations reveals stark differences in how taxes are collected and utilized:

United States: Despite having a moderate tax-to-GDP ratio of around 25%, the U.S. boasts advanced infrastructure, although it faces challenges like aging bridges and underfunded public transport.

Germany: With a tax-to-GDP ratio of about 38%, Germany efficiently uses its taxes to fund exceptional public transport, healthcare, and education systems, offering a clear return on investment for taxpayers.

India: India’s tax-to-GDP ratio hovers around 17%. However, its infrastructure struggles with overcrowded roads, inconsistent electricity, and poor public healthcare, leaving much to be desired. Despite this, the overall tax collection is substantial due to the large population. This raises questions about whether Indian citizens are paying first-world taxes but getting inadequate infrastructure in return.

Nigeria: Despite having significant natural resources, Nigeria’s infrastructure faces chronic issues, and corruption severely undermines public trust.

Why Does India Struggle Despite Significant Tax Revenue?

India’s tax-to-GDP ratio is lower than many developed nations, but the large population ensures substantial revenue. Yet, inefficiencies hinder effective utilization:

Corruption: Misallocation of funds due to corruption is a critical factor. Resources meant for public projects are siphoned off, leaving infrastructure projects underfunded or incomplete.

Bureaucratic Inefficiency: Poor governance and bureaucratic delays hamper the timely execution of projects, inflating costs and reducing efficiency.

Debt Servicing: A significant portion of India’s tax revenue is allocated to servicing public debt, leaving less for infrastructure development or social welfare.

Mismatch of Priorities: Spending on non-productive sectors, such as subsidies and defense, often outweighs investment in critical infrastructure or social services.

High Population, Low Benefits: While the absolute tax revenue is high, its per capita allocation remains insufficient due to the large population. This leads to a lower quality of public services compared to developed nations. Citizens are left wondering if they are paying first-world taxes for outcomes that resemble third-world infrastructure.

The Price of Inefficiency

When taxpayers perceive that their contributions are not being used effectively, it leads to widespread dissatisfaction. This dissatisfaction can drive citizens to evade taxes or demand systemic reforms. Poor infrastructure limits economic growth, creating a vicious cycle where governments fail to generate enough revenue to improve services.

Steps to Bridge the Gap

To address the disparity between taxes collected and services provided, governments must focus on the following:

Transparency and Accountability: Governments must adopt transparent budgeting and expenditure practices to ensure that tax revenue is utilized effectively.

Public Participation: Engaging citizens in decision-making processes related to taxation and public spending fosters trust and ensures that funds are allocated to areas that matter most.

Technology Adoption: Leveraging technology to reduce inefficiencies in tax collection and project execution can significantly improve outcomes.

International Collaboration: Learning from countries that excel in infrastructure development can provide valuable insights for nations struggling to optimize their resources.

Conclusion

The question, “Are we paying first-world taxes for third-world infrastructure?” encapsulates the frustration of millions of taxpayers worldwide, especially in countries like India. While developed nations demonstrate that high taxes can fund exceptional public services, many developing countries have yet to achieve this balance. Addressing inefficiencies, reducing corruption, and fostering public trust are critical to ensuring that taxpayers receive value for their money.

India’s middle class bears a significant tax burden but receives fewer benefits than their counterparts in developed nations. Despite substantial tax revenue, inefficiencies and mismanagement prevent the government from adequately addressing public service needs. Bridging this gap requires systemic reforms, prioritizing critical investments, and fostering trust between the government and its citizens.

Ultimately, taxation is not just about revenue collection; it is a social contract between the government and its people. Breaking this contract risks not only economic stagnation but also public discontent. It is time for nations to reevaluate their priorities and ensure that every dollar or rupee collected in taxes contributes to building the future citizens deserve.

The irony of paying first-world taxes without receiving equivalent services is a global concern, and addressing this disparity should be a priority for policymakers and citizens alike.

Our GST Services

All E-commerce Tax services

E-commerce tax services help online sellers navigate GST registration, compliance, return filing, TCS management, tax planning, and audits, ensuring efficient tax management and legal compliance.

GST Filing

GST filing is the process of submitting tax returns to the government, detailing sales, purchases, and taxes paid or collected, ensuring compliance with GST laws.

GST Registration

GST registration is the process where businesses obtain a GSTIN from the government, allowing them to collect taxes, claim input tax credits, and comply with GST laws.