Are Public Services Worth the Taxes We Pay?

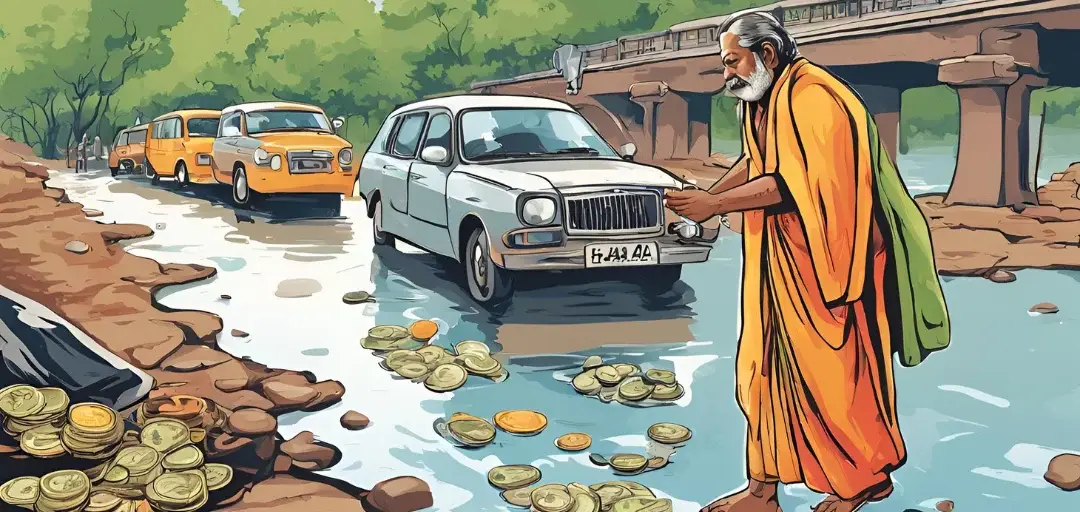

Taxes are integral to funding public services, which form the cornerstone of any modern society. From infrastructure development to healthcare and education, public services are critical to the functioning of a nation. But with the taxes we pay, are we truly receiving value in return? The question, “Are public services worth the taxes we pay?” remains a point of constant debate. Let’s explore the relationship between public services and taxes, examining their value and societal impact.

Understanding Public Services and Taxes

Public services are the essential services provided by the government to its citizens, funded through taxes. Taxes, paid by individuals and businesses, finance these services, which include:

- Infrastructure: Roads, bridges, utilities, and public transport systems.

- Healthcare: Public hospitals, vaccination programs, and health subsidies.

- Education: Public schools, universities, and scholarship programs.

- Safety and Security: Police forces, fire departments, and military defense.

- Welfare Programs: Unemployment benefits, pensions, and social housing.

The core idea behind taxes is to pool resources for the collective benefit of society, ensuring the availability of essential services. However, the efficiency and equity of public services often raise concerns, with many questioning if the taxes they pay are being put to optimal use.

Are Public Services Worth the Taxes We Pay?

To determine whether public services are worth the taxes we pay, we need to evaluate the cost-benefit equation. Ideally, if the quality of public services meets the taxes collected, taxpayers would feel their money is well spent. But inefficiency, bureaucracy, or poor service delivery can make individuals question the value of their tax contributions.

High Taxes, Better Services?

Countries with high tax rates often justify the higher taxes with superior public services. For example:

- Nordic Countries: Denmark, Sweden, and Norway have high tax-to-GDP ratios, yet they rank highly in global indices for healthcare, education, and overall quality of life.

- United States: With lower taxes, the U.S. faces significant disparities in access to public services like healthcare and education.

This disparity underlines the importance of good governance in the efficient use of public services and taxes.

The Challenges Facing Public Services

While public services offer numerous benefits, there are notable challenges that hinder their effectiveness:

Inefficiency and Bureaucracy

Public services are often criticized for their inefficiency, with bureaucratic delays, mismanagement, and corruption being major concerns. For instance, long waiting times in public hospitals or inefficiencies in other services can make taxpayers wonder if their taxes are being spent wisely.

Inequality in Access

Despite paying taxes, many individuals find it difficult to access quality public services. Rural areas, for instance, may lack the infrastructure and facilities that urban centers enjoy, leading to unequal access to services funded by taxes.

Underutilization of Funds

Taxpayer money is sometimes allocated to projects that don’t address the most pressing needs. For example, investing in expensive, non-essential projects like stadiums while neglecting fundamental services like healthcare or education can create resentment among taxpayers who question the value of their contributions.

The Benefits of Public Services

Despite these challenges, public services have undeniable benefits that enhance the quality of life for everyone:

Universal Access

Public services are designed to be universally accessible, ensuring that people from all income brackets benefit from essential services. This promotes social equity and helps reduce poverty.

Economic Stability

Investments in public services and taxes, such as infrastructure and welfare programs, stimulate economic growth and provide safety nets during economic downturns, benefiting both individuals and the economy at large.

Improved Quality of Life

Public services contribute to overall well-being by providing parks, libraries, and cultural programs, which foster social cohesion and community engagement.

Ensuring Public Services Are Worth the Taxes We Pay

For public services to be truly worth the taxes we pay, governments must prioritize transparency, efficiency, and accountability.

Transparency

Governments must disclose how tax revenues are spent. Regular audits and accessible reports can build taxpayer trust and ensure that money is being used responsibly.

Efficiency Measures

To ensure the effective use of taxpayer money, governments should streamline processes, reduce bureaucratic inefficiencies, and adopt technology in public service delivery.

Public Participation

Engaging citizens in decision-making helps align public services with community needs, ensuring that the taxes paid by individuals are used to meet the priorities of society.

How to Assess the Value of Public Services

Taxpayers can assess whether public services are worth the taxes they pay by considering:

- Quality of Services: Are services reliable, accessible, and of high quality?

- Comparative Analysis: How do public services in your country compare to those in other nations with similar economies?

- Personal Benefit: Do you personally benefit from the services provided by the government?

Conclusion

The answer to the question, “Are public services worth the taxes we pay?” is not straightforward. It depends on the efficiency, equity, and transparency with which tax revenues are used to fund services. By fostering better governance and ensuring accountability, governments can make public services truly worth the taxes we pay.

Ultimately, taxes are necessary to fund public services that form the foundation of a prosperous society. The key lies in ensuring that these services are efficient, equitable, and accessible, maximizing the value for every taxpayer. In this way, public services and taxes can work together for the greater good.

Our GST Services

All E-commerce Tax services

E-commerce tax services help online sellers navigate GST registration, compliance, return filing, TCS management, tax planning, and audits, ensuring efficient tax management and legal compliance.

GST Filing

GST filing is the process of submitting tax returns to the government, detailing sales, purchases, and taxes paid or collected, ensuring compliance with GST laws.

GST Registration

GST registration is the process where businesses obtain a GSTIN from the government, allowing them to collect taxes, claim input tax credits, and comply with GST laws.