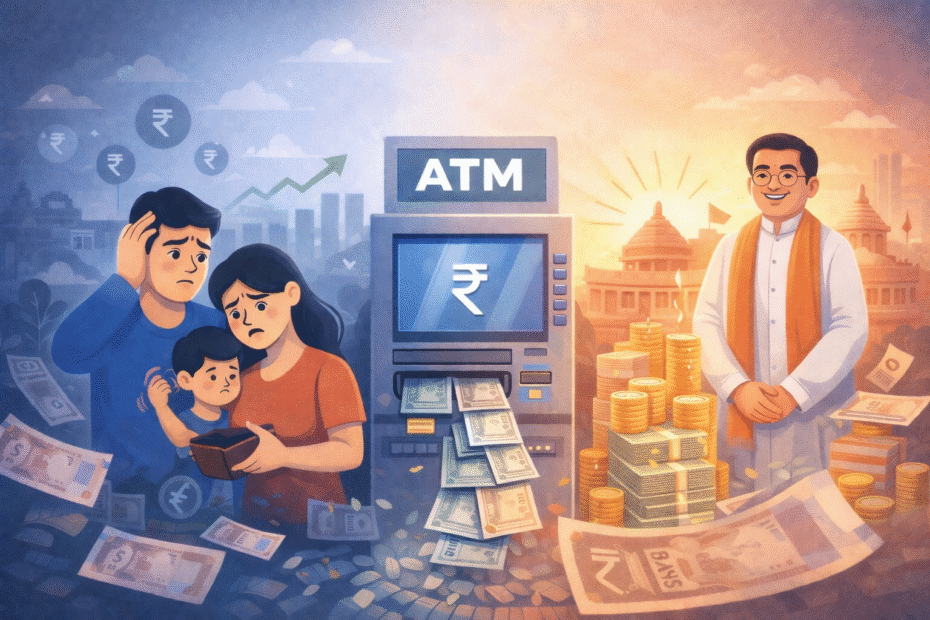

For decades, the Indian middle class has been called the backbone of the nation. They work hard, follow rules, pay taxes honestly, and dream of a stable future for their families. Yet, year after year, a growing question refuses to go away: Is the Indian middle class becoming the government’s Silent ATM?

The phrase Silent ATM Tax Burden perfectly captures the frustration many salaried and small business families feel today. Taxes are deducted automatically, compliance costs are rising, benefits seem limited, and relief often feels symbolic rather than meaningful.

This blog explores why the middle class feels financially squeezed, how the Silent ATM Tax Burden operates, and what taxpayers can do to protect themselves legally and strategically.

Understanding the Silent ATM Tax Burden

The Silent ATM Tax Burden refers to a situation where a specific group—primarily the middle class—consistently contributes a large share of tax revenue without proportional benefits, representation, or relief.

Unlike large corporations that have structured tax planning or informal sectors that often remain outside the tax net, the middle class is:

Highly visible to the tax system

Easy to tax through TDS and GST

Less able to evade or delay payments

Expected to comply fully and silently

This makes the middle class a reliable and predictable source of revenue—much like an ATM that never complains.

Why the Middle Class Feels Targeted

1. Automatic Tax Collection Through TDS

For salaried individuals, income tax is deducted before the salary even reaches their bank account. There is no flexibility, no negotiation, and no delay.

While compliance is important, the lack of choice reinforces the Silent ATM Tax Burden. Taxes are paid first; expenses come later.

2. Limited Tax-Saving Opportunities

Most middle-class taxpayers rely on basic deductions like:

Section 80C (PF, LIC, ELSS)

Section 80D (Health Insurance)

Standard deduction

These limits have not kept pace with inflation, rising education costs, or healthcare expenses. Meanwhile, compliance complexity has increased.

3. High Indirect Taxes on Daily Life

Even after paying income tax, middle-class families face heavy GST on essentials, including:

Fuel (outside GST but heavily taxed)

Insurance premiums

Mobile bills and internet

Home maintenance and appliances

This creates a double burden—direct tax + indirect tax, strengthening the Silent ATM Tax Burden.

Budget Announcements vs Ground Reality

Every Union Budget raises hopes for tax relief. However, middle-class expectations often clash with reality.

Common Budget Promises:

“Tax relief for the common man”

“Boosting disposable income”

“Supporting middle-class aspirations”

Common Outcomes:

Minor slab tweaks

Optional tax regimes with fewer deductions

Compliance-heavy changes without real savings

This growing gap between expectation and outcome fuels the belief that the middle class exists mainly to fund government spending.

Who Actually Benefits More?

1. Corporate Tax Cuts

In recent years, corporate tax rates have been reduced significantly to promote investment and growth. While economically justified, middle-class taxpayers often ask:

“Why are companies getting relief while individuals pay more?”

2. Subsidy-Focused Welfare Programs

Most welfare schemes are targeted at:

Below Poverty Line (BPL) groups

Rural households

Specific voter segments

The middle class usually falls outside eligibility limits—earning “too much” for subsidies but “too little” for financial comfort.

3. Informal Economy Escaping the Net

A large section of the economy still operates in cash or semi-formal systems. The result?

Honest taxpayers pay more

Non-compliant segments contribute less

This imbalance deepens the Silent ATM Tax Burden on compliant citizens.

Psychological Impact on Middle-Class Families

The Silent ATM Tax Burden is not just financial—it is emotional.

Many families feel:

Financially stuck despite rising incomes

Afraid to grow income due to higher tax slabs

Discouraged from entrepreneurship

Constantly audited, tracked, and monitored

Instead of feeling empowered, taxpayers often feel punished for honesty.

Is the New Tax Regime a Solution?

The government introduced optional tax regimes promising simplicity and lower rates. However, for many middle-class taxpayers:

Deductions are lost

Savings discipline weakens

Real tax savings are minimal

For families with home loans, insurance, children’s education, and medical expenses, the old regime often still makes more sense.

This again raises the question—is simplification masking the Silent ATM Tax Burden rather than solving it?

How the Middle Class Can Fight Back—Legally

While the system may feel unfair, smart planning can reduce the impact of the Silent ATM Tax Burden.

1. Strategic Tax Planning (Not Last-Minute Saving)

Tax planning should be done at the beginning of the financial year—not in March panic mode.

Professional planning can help:

Optimize deductions

Choose the right tax regime

Structure salary efficiently

Avoid unnecessary taxes

2. Use Family-Based Planning

Many families overpay tax by ignoring:

Income splitting opportunities

HUF benefits

Clubbing provisions

Senior citizen exemptions

Legal structuring can significantly reduce tax liability.

3. Don’t Ignore Compliance Benefits

Proper filing and compliance help in:

Faster refunds

Avoiding penalties

Clean financial records

Easier loans and visas

The goal is not to evade tax—but to pay only what is legally required, nothing more.

The Role of Tax Professionals

Navigating the Silent ATM Tax Burden alone is risky. Laws change frequently, interpretations evolve, and mistakes are costly.

A professional tax advisor:

Understands budget implications

Interprets new tax rules correctly

Protects you during scrutiny or notices

Aligns tax planning with long-term goals

For middle-class families, expert guidance is no longer optional—it is essential.

Final Thoughts: Silent, But Not Powerless

The Indian middle class may feel like the government’s Silent ATM—but silence does not mean helplessness.

Awareness, planning, and professional support can:

Reduce unnecessary tax outflow

Improve financial stability

Restore confidence in the system

The Silent ATM Tax Burden is real, but with the right approach, middle-class taxpayers can regain control over their money—legally, ethically, and smartly.

About Taxamicus

At taxamicus.in, we help individuals and families navigate India’s complex tax system with clarity, strategy, and confidence. Our goal is simple:

You should pay taxes—but never more than what the law requires.

Our GST Services

All E-commerce Tax services

E-commerce tax services help online sellers navigate GST registration, compliance, return filing, TCS management, tax planning, and audits, ensuring efficient tax management and legal compliance.

GST Filing

GST filing is the process of submitting tax returns to the government, detailing sales, purchases, and taxes paid or collected, ensuring compliance with GST laws.

GST Registration

GST registration is the process where businesses obtain a GSTIN from the government, allowing them to collect taxes, claim input tax credits, and comply with GST laws.