Middle Class, Maximum Tax: The Unfair Burden of BJP’s Tax Policies

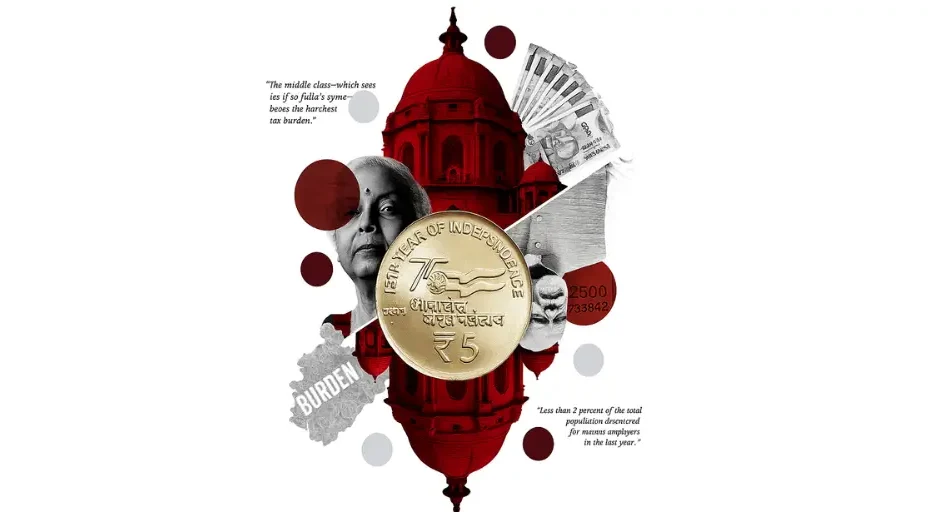

The middle class in India has long been hailed as the backbone of the nation’s economy. Yet, over the past decade, it seems that this vital segment of society has been shouldering an increasingly heavy financial burden. Central to this strain is the evolving landscape of middle class taxation in India, which has, in many ways, become both complex and punishing under recent government policies.

The Rising Burden on the Middle Class

Historically, the Indian middle class has been expected to contribute its fair share to the nation’s development through income taxes and consumption taxes. However, recent years have seen a noticeable escalation in the financial pressures they face. Middle class taxation in India has not only increased in terms of sheer rates but also in its complexity, making compliance a daunting task. For salaried individuals and small business owners, the burden is often disproportionate to the actual income earned.

The introduction of policies such as the Goods and Services Tax (GST) was initially promoted as a simplification of the taxation system. Yet, for the middle class, it has often resulted in higher indirect taxes on essential goods and services. The net effect is that middle class taxation in India has grown more burdensome, reducing disposable income and affecting quality of life.

The Illusion of Tax Relief

While the government has periodically announced income tax exemptions and slabs aimed at relieving the middle class, the reality is quite different. Increases in indirect taxes, inflationary pressures, and stricter compliance measures offset these benefits. The result is an uneven financial playing field where the middle class continues to bear the brunt of the tax burden. Analysts argue that this trend points to a deeper structural issue in middle class taxation in India, where reforms intended to help often end up complicating the financial scenario.

Moreover, with each new budget announcement, the middle class faces the dual challenge of understanding complex provisions while planning their personal finances. This constant strain highlights how middle class taxation in India is not just a matter of paying taxes—it’s about navigating a system that often seems designed for the wealthy or large corporations, leaving the average citizen under pressure.

Impact on Daily Life

The effects of increased taxation are far-reaching. Middle-class families often find themselves cutting back on discretionary spending, delaying investments, and even borrowing to meet tax obligations. The burden of middle class taxation in India is felt not only in the immediate financial sense but also in long-term economic planning. Families have less flexibility to invest in education, health, and other crucial areas, which can ultimately impact the broader economy.

Education and healthcare expenses, already significant for most middle-class households, are further strained by higher indirect taxes. Everyday purchases, from groceries to utilities, now carry a hidden cost that adds to the financial stress. This growing imbalance underscores the pressing need to rethink middle class taxation in India to ensure fairness and sustainability.

Policy Decisions and Their Consequences

The BJP government has often defended its tax policies by emphasizing increased government revenues, improved public services, and economic modernization. However, the middle class sees a different picture. Policies aimed at increasing direct and indirect taxation without adequate relief measures have intensified the financial burden on ordinary citizens.

Middle class taxation in India today is characterized by higher income tax rates for certain brackets, increased surcharges, and complicated compliance norms. While these measures may help in revenue collection, they do little to address the strain felt by middle-income earners. Many economists argue that a more balanced approach, targeting tax evasion and high-income earners more effectively, could alleviate the pressure on the middle class.

The Hidden Costs

Another critical aspect of middle class taxation in India is the hidden costs associated with compliance. Time spent understanding tax laws, hiring professional help, and filing returns is often substantial. For small entrepreneurs and salaried professionals, this translates into indirect financial losses that are rarely accounted for in official statistics. The cumulative effect is a middle class that feels overtaxed, undervalued, and increasingly skeptical of the system’s fairness.

Additionally, the psychological impact of high taxation cannot be overlooked. Constant scrutiny, fear of penalties, and the pressure to comply with ever-changing regulations contribute to stress and anxiety. For a demographic that forms the core of India’s workforce, this represents a significant social and economic concern.

The Need for Reform

Experts widely agree that the current approach to middle class taxation in India needs urgent reform. Simplifying tax slabs, reducing indirect taxes on essential goods, and improving transparency in enforcement are crucial steps. Moreover, the government must ensure that reforms genuinely benefit the middle class rather than disproportionately favoring corporations or the wealthiest segments of society.

Education campaigns to help citizens understand their rights and responsibilities, coupled with efficient grievance redressal mechanisms, can also play a significant role in reducing the burden. By making the tax system more transparent and equitable, India can foster trust and compliance rather than resentment and evasion.

Conclusion

The narrative surrounding India’s middle class is often about growth, aspiration, and opportunity. Yet, when it comes to taxation, the story is markedly different. Middle class taxation in India has become a complex web of high direct and indirect taxes, compliance pressures, and financial stress. Policies under the BJP government, while intended to modernize the economy, have in practice resulted in an unfair burden on those who form the backbone of the nation.

Addressing these issues is not just about policy correction—it is about preserving the financial well-being and morale of millions of Indian citizens. Only a thoughtful, balanced approach to middle class taxation in India can ensure fairness, stimulate economic growth, and maintain social harmony. The time to act is now, before the middle class faces even greater financial strain under an already heavy tax burden.

Our GST Services

All E-commerce Tax services

E-commerce tax services help online sellers navigate GST registration, compliance, return filing, TCS management, tax planning, and audits, ensuring efficient tax management and legal compliance.

GST Filing

GST filing is the process of submitting tax returns to the government, detailing sales, purchases, and taxes paid or collected, ensuring compliance with GST laws.

GST Registration

GST registration is the process where businesses obtain a GSTIN from the government, allowing them to collect taxes, claim input tax credits, and comply with GST laws.